Skip Navigation

Search

Dealing With Checks

Checks are not as widely used as they once were. So, what are they? What can they be used for?

- Checks are used for things that you wouldn't normally give your credit/debit card number out for and is an alternative for paying cash.

- One of the most common check payments for college students is rent payments. Sometimes, the owner of the house/apartment will want checks as payment, plus it serves as proof of payment.

- Most of the time, students' interaction with checks is limited to paychecks

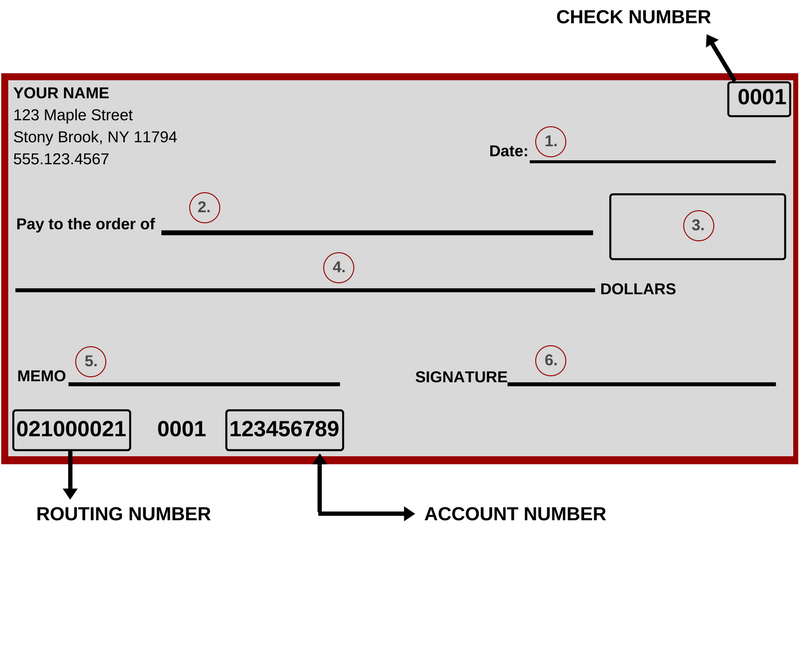

How to Write a Check

- Write the date. A check cannot be cashed prior to the date written here.

- Indicate who the check is going to. If you are paying a bill, the bill will usually specify "Make checks payable to...". If you are confused, it never hurts to ask.

- Write the numerical amount of the check in the box.

- Write the words of the amount in step 3. For example, if you are writing a check in the amount of $43.98, you would write "Forty-three and 98/100". If there is any space remaining on the line, draw a line through that space. This prevents anyone from altering the amount.

- This is optional but it can be useful to make a note of why you were writing the check.

- Sign the check. The check is not valid until you do so.

CHECK NUMBER: Allows you to easily identify a check in a registry, on your statement, etc.

ROUTING NUMBER: Identifies your bank and allows financial institutions process the check

ACCOUNT NUMBER: Identifies your account number with the bank

Endorsing a Check

Blank Endorsement

- When you sign the back of the check and that's all

- Easiest but most dangerous

- Only do this if you're at the bank getting ready to deposit the check

Restrictive Endorsement

- Signing and including your account number with your endorsement

Example: "For deposit only to account #####" OR "For deposit only to account of [your name]

This restricts the check from being deposited to an account other than the one you specify.

No Endorsement

- Some banks don't not require you to endorse the check before depositing it

- Keeps information private

Additional Information

- Checks have the benefit of a paper trail - many banks provide an image of your written checks as part of your monthly statement.

- Checks you write include your account number, name and address - don't leave them laying around & only give them to reputable people/business.

- If you don't keep track of the checks you write, you could overdraw your account and have to pay a "bounced check" fee.